Fill Out w8 form

1. Open the form

Access the pre-loaded form directly in our PDF editor. No need to upload anything!

2. Fill in your details

Carefully complete all required fields to ensure accuracy and validity.

3. Download as PDF

Save your filled-out form in PDF format, ready for submission or other needs.

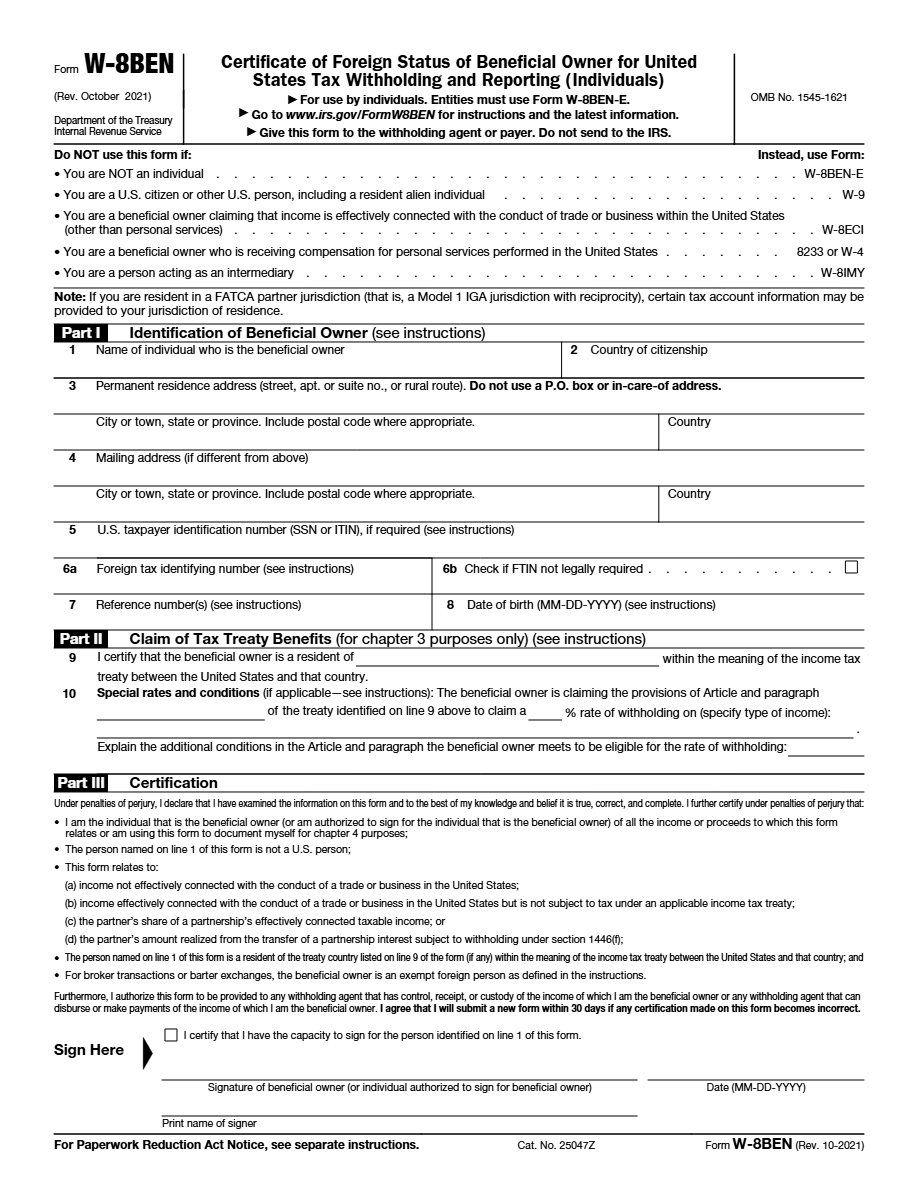

What is w8 form Form?

Form W-8 is a document used by foreign entities or individuals who receive income from U.S. sources. This form is provided to the payer or company making the payments to certify that the beneficiary is foreign and thus subject to specific withholding rules.

What is Form w8 form used for?

Form W-8 is used to certify the foreign status of the beneficiary and to claim a reduction in tax withholding on payments such as royalties, investment income, or any other income generated in the USA.

Who should complete Form w8 form?

Form W-8 must be completed by any foreign entity or individual who receives payments from U.S. sources and wishes to certify their status for tax purposes.

Legal and regulatory information

Form W-8 is backed by the United States Internal Revenue Code, and its proper submission is required to avoid the maximum 30% withholding on payments made to non-resident or foreign entities.

How to fill out w8 form Form?

Provide your full legal name, address, and country of tax residence.

Select the entity type that best describes your status, such as individual, corporation, or partnership.

Check the relevant boxes and sign the form to certify your understanding and accuracy of the information provided.

If claiming benefits under a tax treaty, provide details of the treaty and applicable withholding rates.

Fill out your w8 form Form here

Some important tips

FAQ about w8 form Form

You should send the form to the income payer, not to the IRS.