Fill Out w-9

1. Open the form

Access the pre-loaded form directly in our PDF editor. No need to upload anything!

2. Fill in your details

Carefully complete all required fields to ensure accuracy and validity.

3. Download as PDF

Save your filled-out form in PDF format, ready for submission or other needs.

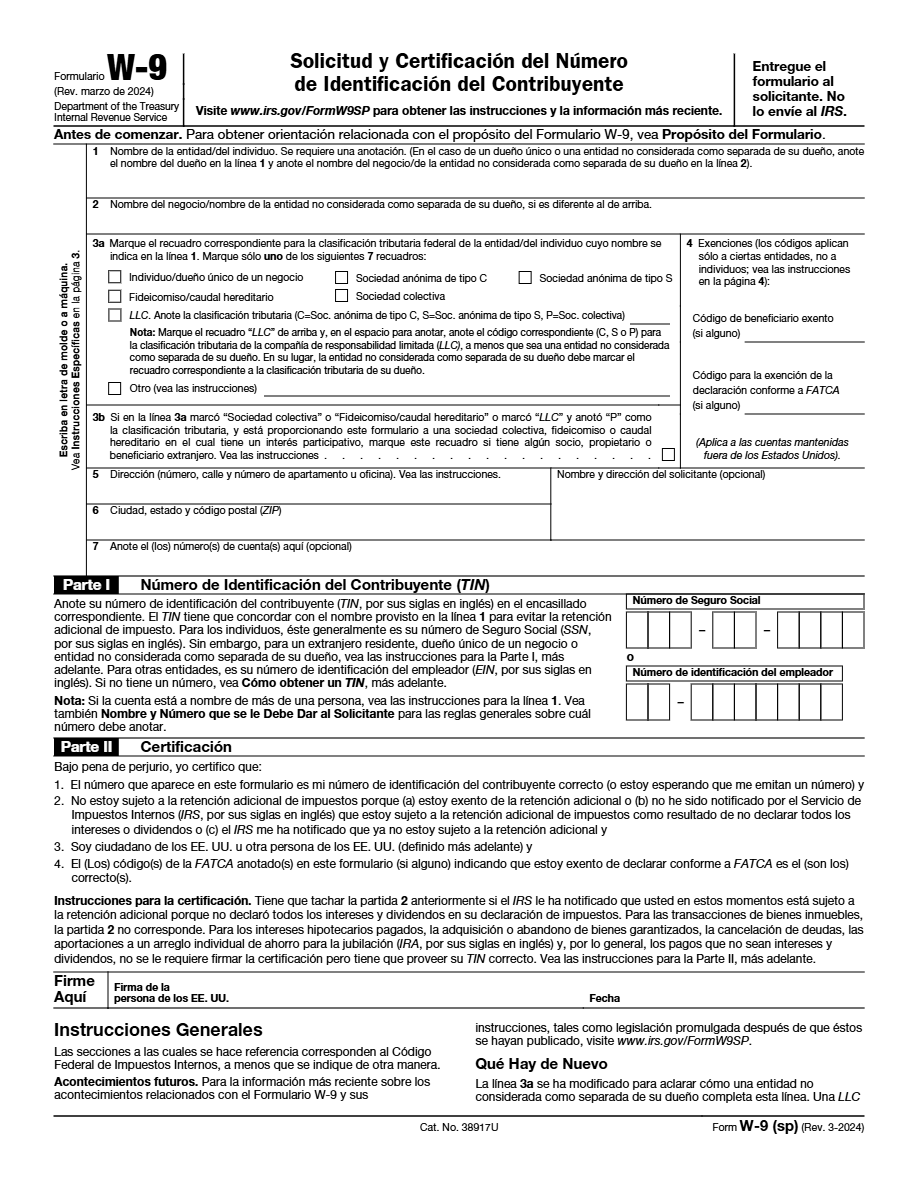

What is w-9 Form?

The W-9 Form is an IRS document used by taxpayers in the United States to provide their Taxpayer Identification Number (TIN) to an entity that needs to report paid income, such as an employer or a financial institution. It is essential for fulfilling withholding and reporting tax requirements.

What is Form w-9 used for?

This form is primarily used by independent contractors, freelancers, and self-employed individuals to provide their personal and tax information to entities that pay them. It facilitates income reporting to the IRS and ensures tax obligations are met.

Who should complete Form w-9?

The W-9 Form must be completed by any individual or entity receiving income subject to tax reporting from a payer, including independent contractors, freelancers, and vendors.

Legal and regulatory information

U.S. Social Security and Internal Revenue Codes require payers to have the TIN of individuals they pay income to. Failing to submit a W-9 when requested can result in additional withholding or penalties.

How to fill out w-9 Form?

Write your full name as it appears on your tax return or Social Security records.

If operating under a fictitious or business name, provide that name here.

Check the box corresponding to your entity type, such as individual, LLC, corporation, etc.

If you are exempt from reporting, indicate the applicable exemption code.

Enter the full address where you wish to receive any related correspondence.

Provide your TIN, which may be an SSN, EIN or other type of tax identification number.

Sign the form and include the date to certify that all the information is correct and true.

Fill out your w-9 Form here

Some important tips

FAQ about w-9 Form

You need to fill out a W-9 to provide your TIN to entities reporting paid income to the IRS.