Fill Out w-7

1. Open the form

Access the pre-loaded form directly in our PDF editor. No need to upload anything!

2. Fill in your details

Carefully complete all required fields to ensure accuracy and validity.

3. Download as PDF

Save your filled-out form in PDF format, ready for submission or other needs.

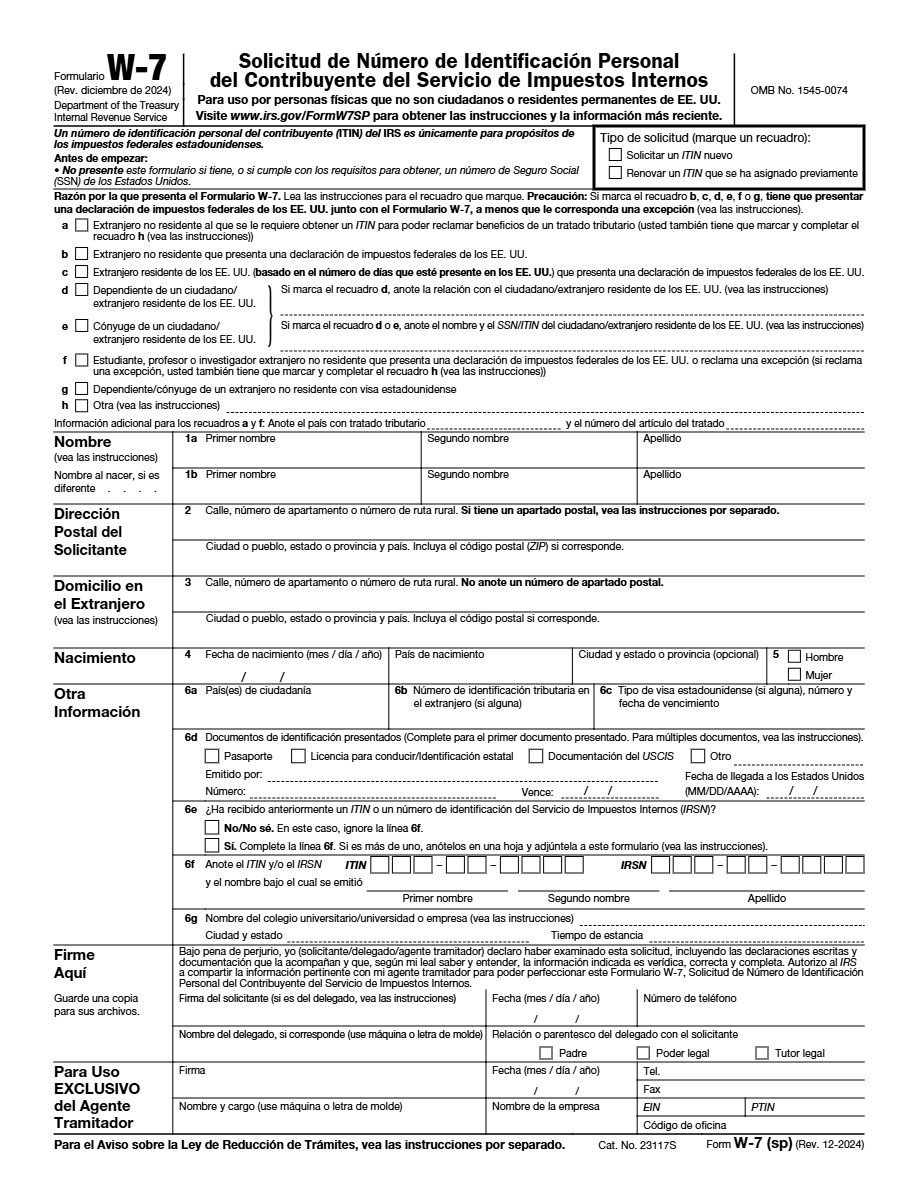

What is w-7 Form?

The W-7 Form is used by individuals who are not eligible to obtain a Social Security Number in the United States but need an Individual Taxpayer Identification Number (ITIN) to comply with U.S. tax obligations.

What is Form w-7 used for?

This form is primarily used to apply for an ITIN for those who do not have an SSN and need to file a tax return or for withholding tax purposes.

Who should complete Form w-7?

The W-7 Form must be completed by those who need an ITIN to file their taxes, including non-resident aliens, resident aliens, dependents, or spouses of a U.S. citizen or resident alien.

Legal and regulatory information

U.S. tax law requires all individuals who earn income or file a federal tax return and are not eligible for an SSN to obtain an ITIN. Failing to file a W-7 when required can result in penalties.

How to fill out w-7 Form?

Write your name as it appears on your passport or other official identification document.

Provide the address where you wish to receive correspondence from the IRS.

Select the most appropriate reason for applying for an ITIN, such as filing taxes or claiming a tax benefit.

Include certified or notarized copies of your identification documents, such as a passport or birth certificate.

Sign the form and date it to certify that the information is accurate and verifiable.

Fill out your w-7 Form here

Some important tips

FAQ about w-7 Form

You will need to provide documentation that verifies your identity and foreign status, such as a passport, foreign driver’s license, or military ID.