Fill Out W-4 Form

1. Open the form

Access the pre-loaded form directly in our PDF editor. No need to upload anything!

2. Fill in your details

Carefully complete all required fields to ensure accuracy and validity.

3. Download as PDF

Save your filled-out form in PDF format, ready for submission or other needs.

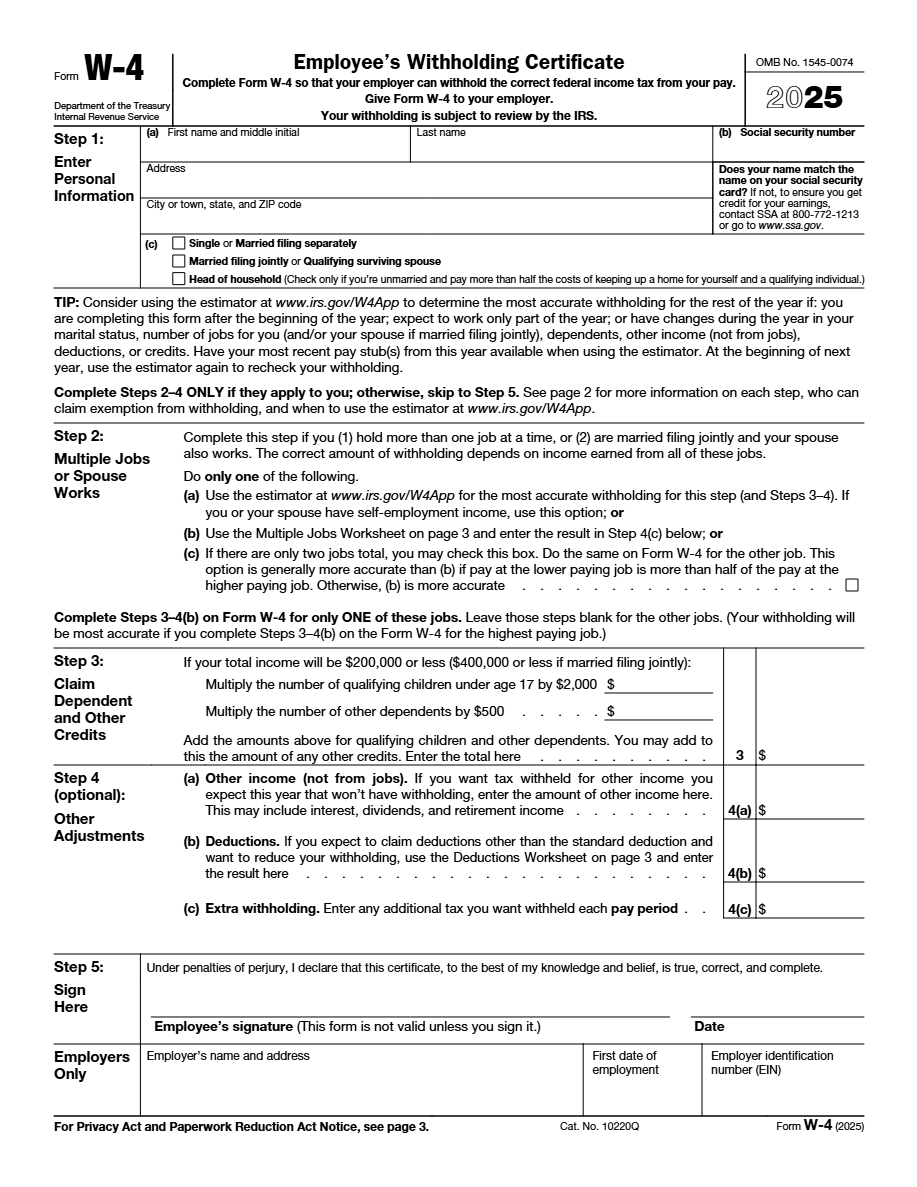

What is W-4 Form Form?

Form W-4 is a tax document used by employers in the United States to determine the correct amount of federal taxes to withhold from an employee's paycheck. It is essential for the accurate calculation of annual tax obligations.

What is Form W-4 Form used for?

The form is used to establish how much federal tax should be withheld from an employee’s pay throughout the year, based on the number of deductions the employee plans to claim.

Who should complete Form W-4 Form?

Every salaried worker who receives an income subject to federal tax in the United States must accurately complete Form W-4 at the start of employment.

Legal and regulatory information

It is required by the Internal Revenue Service (IRS) and must be submitted to the employer when starting a new job or when an employee's tax situation changes.

How to fill out W-4 Form Form?

Enter your full name, address, and Social Security number in the corresponding fields.

Select your current marital status. This will affect the amount of taxes withheld.

Include the number of dependents to adjust your tax withholding.

Specify if you want more or less tax withheld based on additional deductions.

You can further adjust withholdings by indicating a specific additional amount to withhold each pay period.

Sign the form to certify that the information provided is true and accurate and enter the date of signature.

Fill out your W-4 Form Form here

Some important tips

FAQ about W-4 Form Form

If you fail to complete Form W-4, your employer will withhold federal taxes based on the single marital status with no deductions.