Fill Out w-4

1. Open the form

Access the pre-loaded form directly in our PDF editor. No need to upload anything!

2. Fill in your details

Carefully complete all required fields to ensure accuracy and validity.

3. Download as PDF

Save your filled-out form in PDF format, ready for submission or other needs.

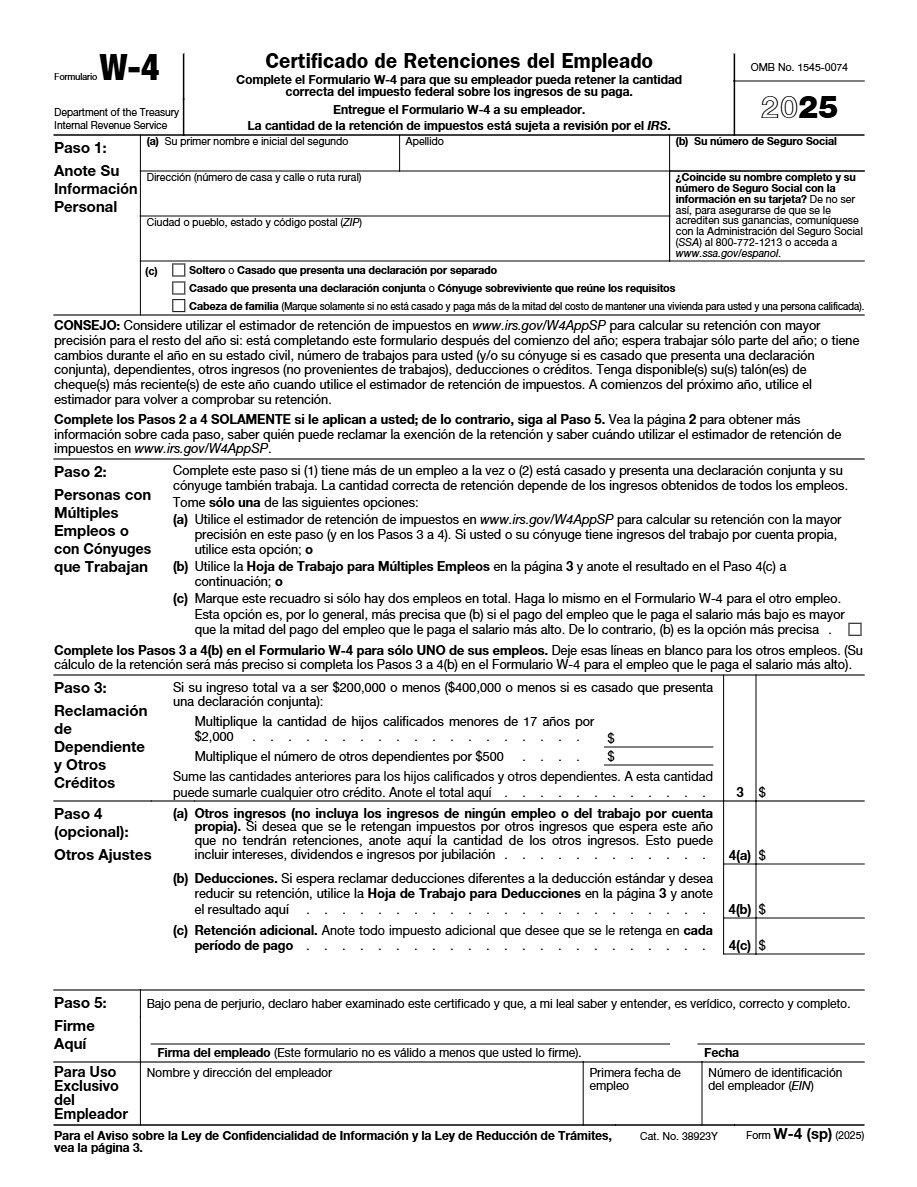

What is w-4 Form?

The W-4 Form is a document used by employees in the United States to calculate the amount of federal income tax to be withheld from their pay. It is crucial for ensuring the correct amount is withheld to meet tax obligations.

What is Form w-4 used for?

The form is used to guide employers on the correct amount of tax to withhold from an employee's pay, preventing the employee from owing money at the end of the fiscal year or receiving a too-large refund.

Who should complete Form w-4?

The W-4 Form must be completed by anyone starting a new job or experiencing significant changes in their tax situation, such as marital status or dependents.

Legal and regulatory information

The Income Tax Act requires employees to complete this form to help employers withhold the correct amount of federal tax. Failing to submit or incorrectly submitting it can result in penalties.

How to fill out w-4 Form?

Enter your full name and address as they appear on your official tax documents.

Select your tax filing status, such as Single, Married, or Head of Household.

Complete the worksheets to calculate your allowances and adjust the numbers according to your withholding preferences.

Indicate if you wish to have extra withholding to cover taxes from various sources or specific tax benefits.

Sign and date the form to certify that the information provided is accurate, complete, and correct.

Fill out your w-4 Form here

Some important tips

FAQ about w-4 Form

If you do not submit the form, your employer must withhold taxes as if you are single with no dependents, which might not reflect your actual tax situation.