Fill Out w-14

1. Open the form

Access the pre-loaded form directly in our PDF editor. No need to upload anything!

2. Fill in your details

Carefully complete all required fields to ensure accuracy and validity.

3. Download as PDF

Save your filled-out form in PDF format, ready for submission or other needs.

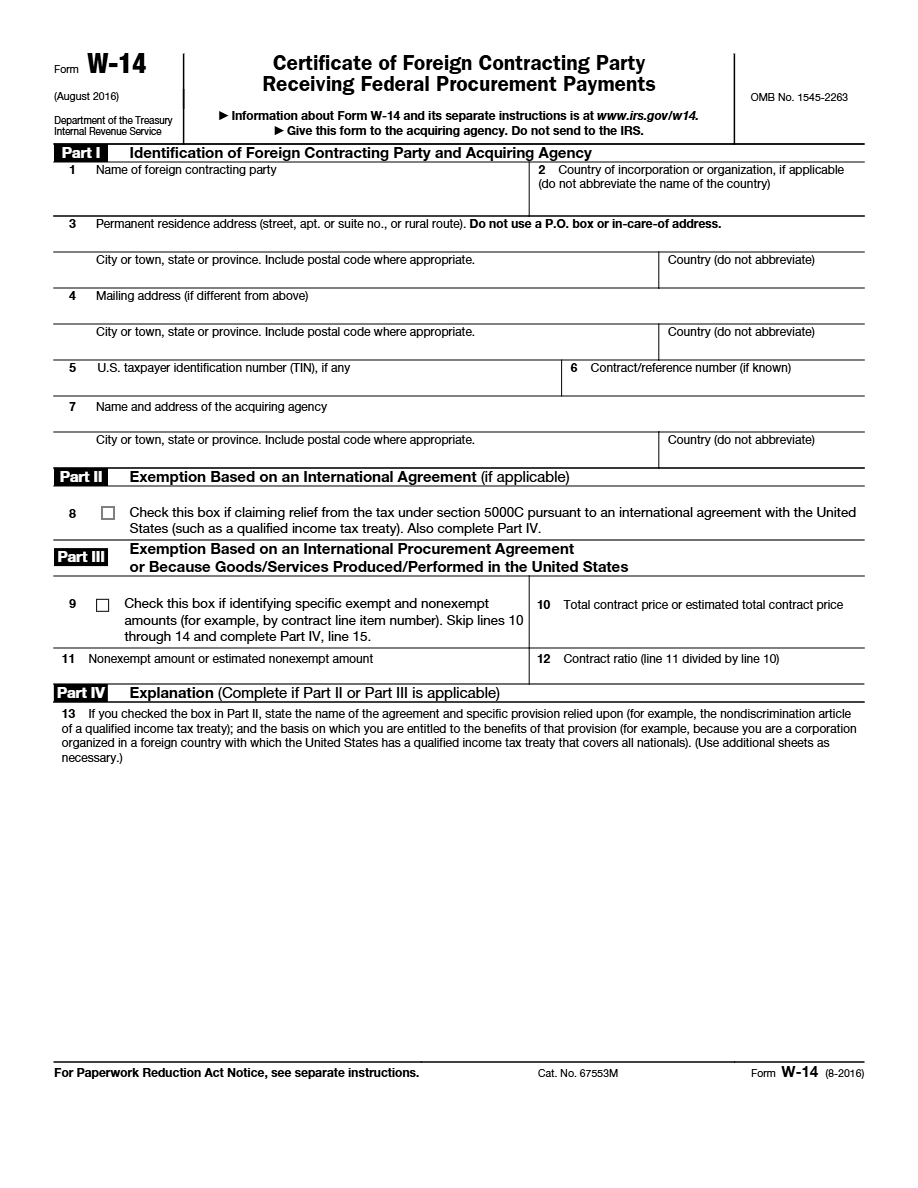

What is w-14 Form?

The W-14 Form is used by U.S. entities to claim an exemption or reduction of the backup withholding tax on payments they make to foreign beneficiaries. It is essential in aligning international tax regulations with U.S. laws.

What is Form w-14 used for?

This form is primarily used by U.S. entities to document the exemption from or reduction of withholding on payments made to foreigners who qualify under certain tax treaties.

Who should complete Form w-14?

The W-14 Form must be completed by U.S. entities making payments to foreign entities that qualify for tax treaty benefits.

Legal and regulatory information

According to U.S. tax law, compliance with withholding provisions is mandatory, and entities must document any exemption to avoid penalties. The W-14 Form helps maintain clear records subject to international compliance audit.

How to fill out w-14 Form?

Enter the full name of the entity making payments to a foreign beneficiary.

Provide the Tax Identification Number (TIN) of the entity making payments.

Indicate the total amount of money paid to the foreign beneficiary within the specified term.

Detail the reason for payments, such as royalties, rents, or other income.

Specify the tax treaty under which the withholding exemption or reduction is being claimed.

Sign and date the form to certify that all the information provided is true and accurate.

Fill out your w-14 Form here

Some important tips

FAQ about w-14 Form

It must be filled out by U.S. entities paying income to foreign beneficiaries and seeking withholding exemptions.