Fill Out w-12

1. Open the form

Access the pre-loaded form directly in our PDF editor. No need to upload anything!

2. Fill in your details

Carefully complete all required fields to ensure accuracy and validity.

3. Download as PDF

Save your filled-out form in PDF format, ready for submission or other needs.

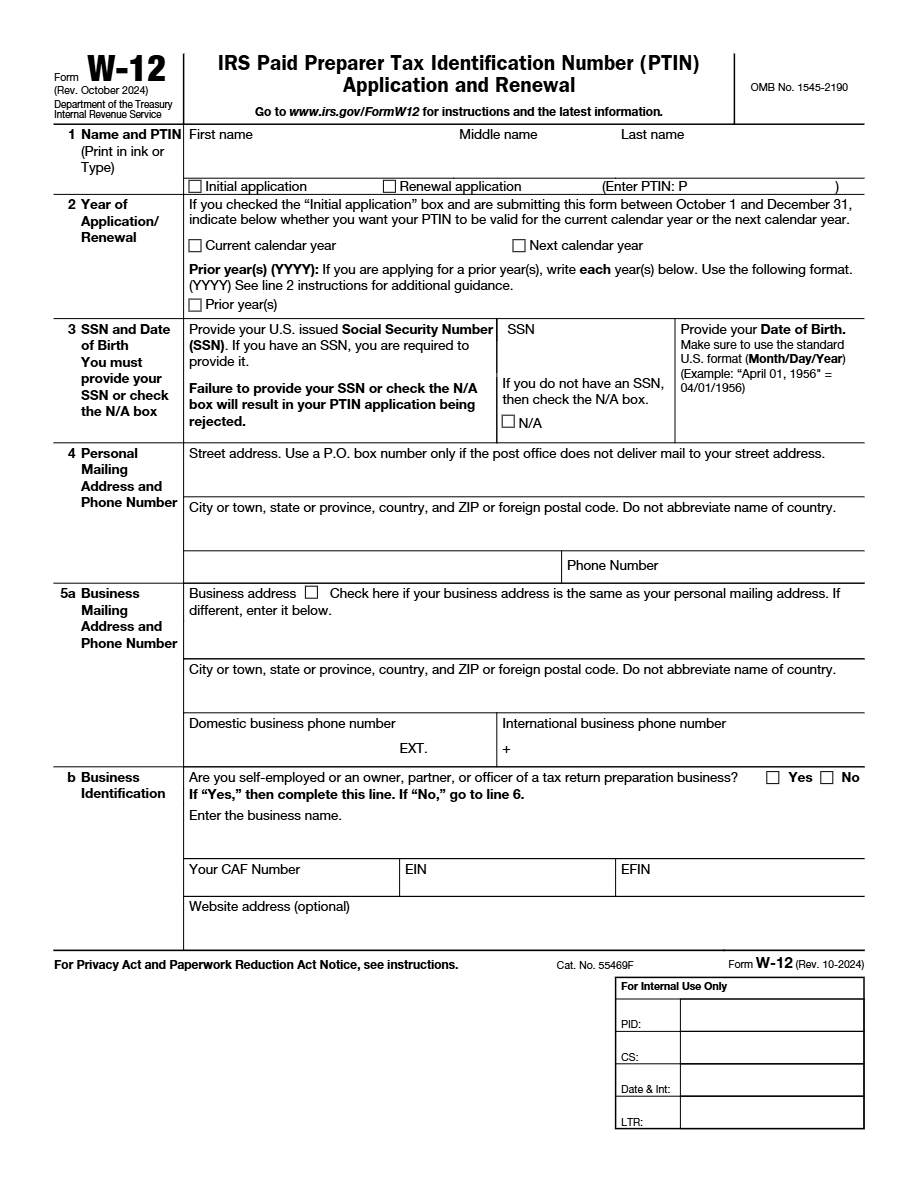

What is w-12 Form?

Form W-12 is a document from the Internal Revenue Service (IRS) that must be completed by individuals applying for or renewing a Preparer Tax Identification Number (PTIN). This number is essential for anyone who prepares tax returns in the United States and is compensated for their services.

What is Form w-12 used for?

Form W-12 is used to apply for or renew the Preparer Tax Identification Number (PTIN). It is a fundamental tool to ensure that tax preparers are registered in the IRS system.

Who should complete Form w-12?

The form must be completed by anyone who prepares or helps prepare federal income tax returns for compensation.

Legal and regulatory information

It is mandatory to present a valid PTIN to the IRS every time a tax return prepared by a professional is filed. Not having a valid PTIN can result in penalties and fines from the IRS.

How to fill out w-12 Form?

Fill in your full name, Social Security number, and current residential address. Ensure it matches the legal documents you have registered.

Indicate whether you are applying for a new PTIN or renewing an existing one. Check the appropriate box.

Provide information on any prior positions related to tax preparation or any relevant professional licenses.

Read and agree to the required declarations, then sign and date the document to validate your application.

Fill out your w-12 Form here

Some important tips

FAQ about w-12 Form

A PTIN is a Preparer Tax Identification Number required for anyone who prepares tax returns in the United States.