Fill Out TD1ON

1. Open the form

Access the pre-loaded form directly in our PDF editor. No need to upload anything!

2. Fill in your details

Carefully complete all required fields to ensure accuracy and validity.

3. Download as PDF

Save your filled-out form in PDF format, ready for submission or other needs.

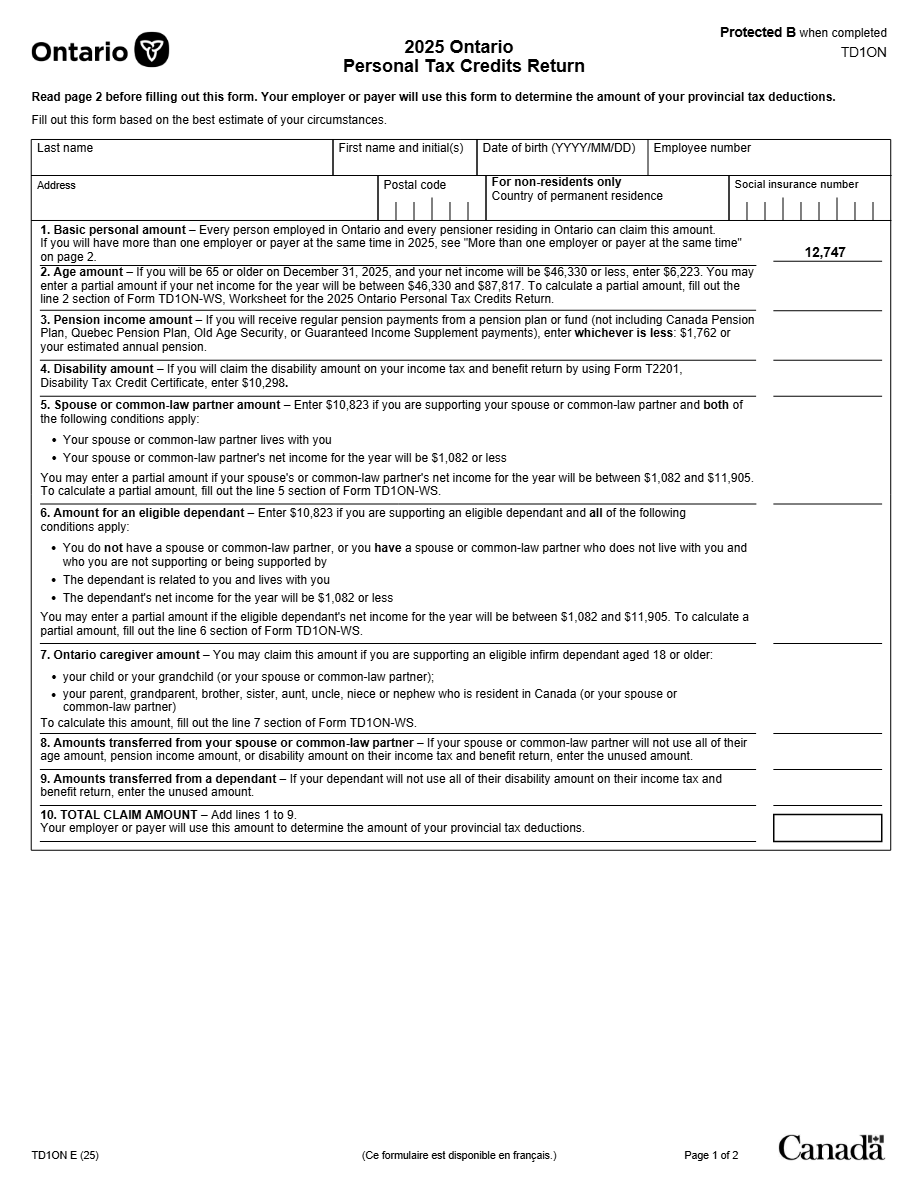

What is TD1ON Form?

The TD1ON form is Ontario's personal tax credits return form used in Canada. This document is used to calculate the correct amount of tax to be withheld from your pay. It complements the federal TD1 form but is specifically designed for Ontario residents.

What is Form TD1ON used for?

The TD1ON form is used to determine the amount of personal tax credits a person can claim in Ontario. This helps calculate the correct amount of tax withheld from each paycheck, avoiding overpayment or underpayment of taxes throughout the year.

Who should complete Form TD1ON?

The TD1ON form must be completed by all employees starting a new job in Ontario or those wishing to change their withholding tax amount. It's also necessary for those experiencing a significant change in their personal tax circumstances.

Legal and regulatory information

The TD1ON form is regulated by the Canada Revenue Agency (CRA) and must be submitted to ensure compliance with provincial tax legislation. It is a legal requirement for all Ontario employees to ensure the correct calculation of their provincial income tax.

How to fill out TD1ON Form?

Enter your full name, address, and Social Insurance Number as requested on the form to ensure proper identification.

Review each line of the form to calculate the total personal tax credits you can claim. These include credits for dependents and disabilities.

Complete this section if you expect changes in your personal circumstances throughout the year, which could affect your deduction amount.

Make sure to sign and date the form where required to validate the information provided.

Fill out your TD1ON Form here

Some important tips

FAQ about TD1ON Form

If you don't complete the TD1ON form, the amount of tax withheld from your salary may not be calculated correctly, which could result in a significant tax adjustment at year-end.