Fill Out TD1AB

1. Open the form

Access the pre-loaded form directly in our PDF editor. No need to upload anything!

2. Fill in your details

Carefully complete all required fields to ensure accuracy and validity.

3. Download as PDF

Save your filled-out form in PDF format, ready for submission or other needs.

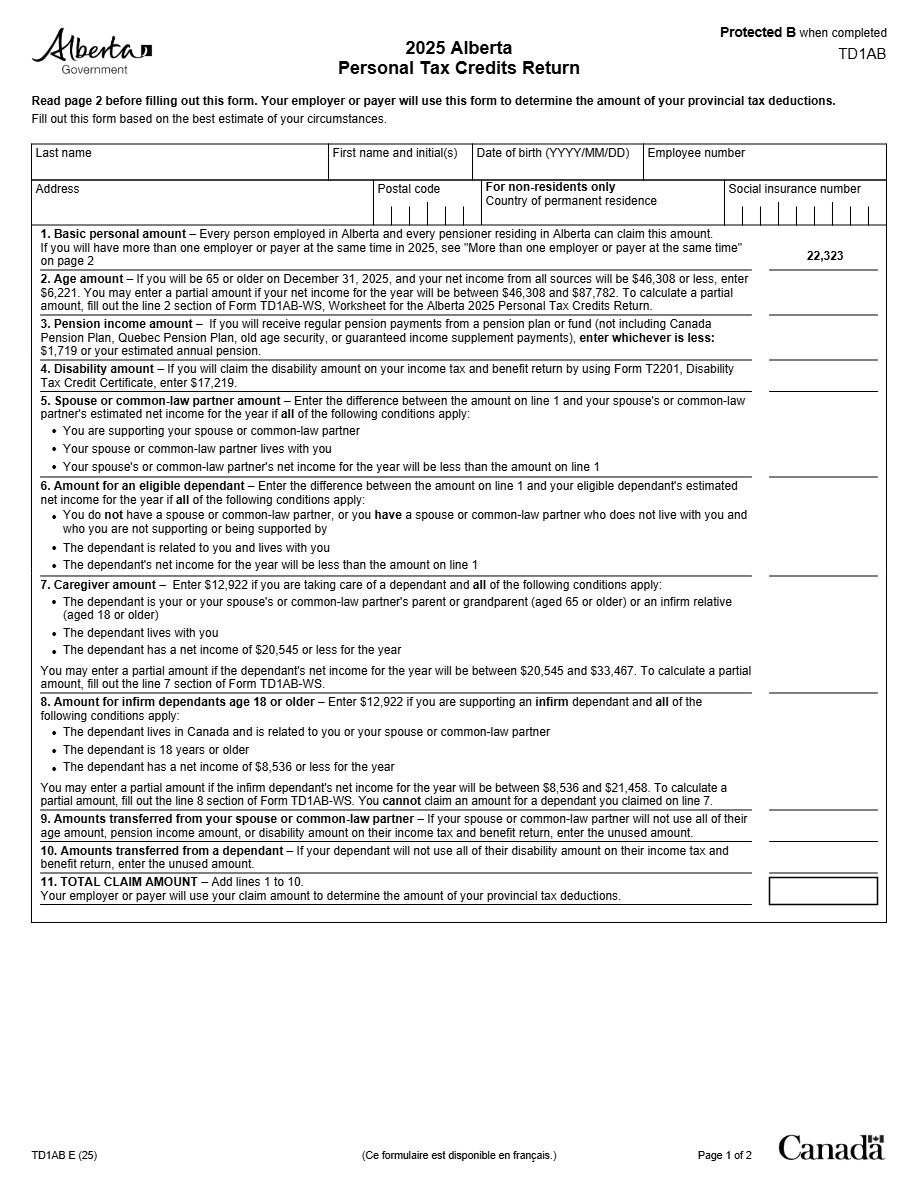

What is TD1AB Form?

The TD1AB form is the Personal Tax Credits Return for Alberta in Canada. It is used by employers and payers in Alberta to determine the amount of tax that should be deducted from an employee's or payee's income in this province.

What is Form TD1AB used for?

The form is used to calculate the correct amount of tax that should be deducted from wages or payments made to workers in Alberta. It helps both employers and employees comply with provincial tax laws.

Who should complete Form TD1AB?

It must be completed by any employee who works in Alberta and expects to have taxable income. It is also necessary for individuals receiving payments subject to tax deduction in this province.

Legal and regulatory information

The TD1AB form is based on tax regulations established by the Alberta government in conjunction with Canada's federal tax legislation. Deductions are made according to these regulations to ensure tax compliance.

How to fill out TD1AB Form?

Fill this section with your full name and social insurance number. Ensure the information provided matches exactly with your official records.

Indicate the personal exemptions you are eligible for based on your personal and family situation to adjust tax deductions.

If you have additional approved deductions, fill out this section to ensure all figures are correct.

After completing the form, ensure you sign and date it to validate the document.

Fill out your TD1AB Form here

Some important tips

FAQ about TD1AB Form

It is the form used to declare personal tax credits in Alberta, Canada.