Fill Out T5

1. Open the form

Access the pre-loaded form directly in our PDF editor. No need to upload anything!

2. Fill in your details

Carefully complete all required fields to ensure accuracy and validity.

3. Download as PDF

Save your filled-out form in PDF format, ready for submission or other needs.

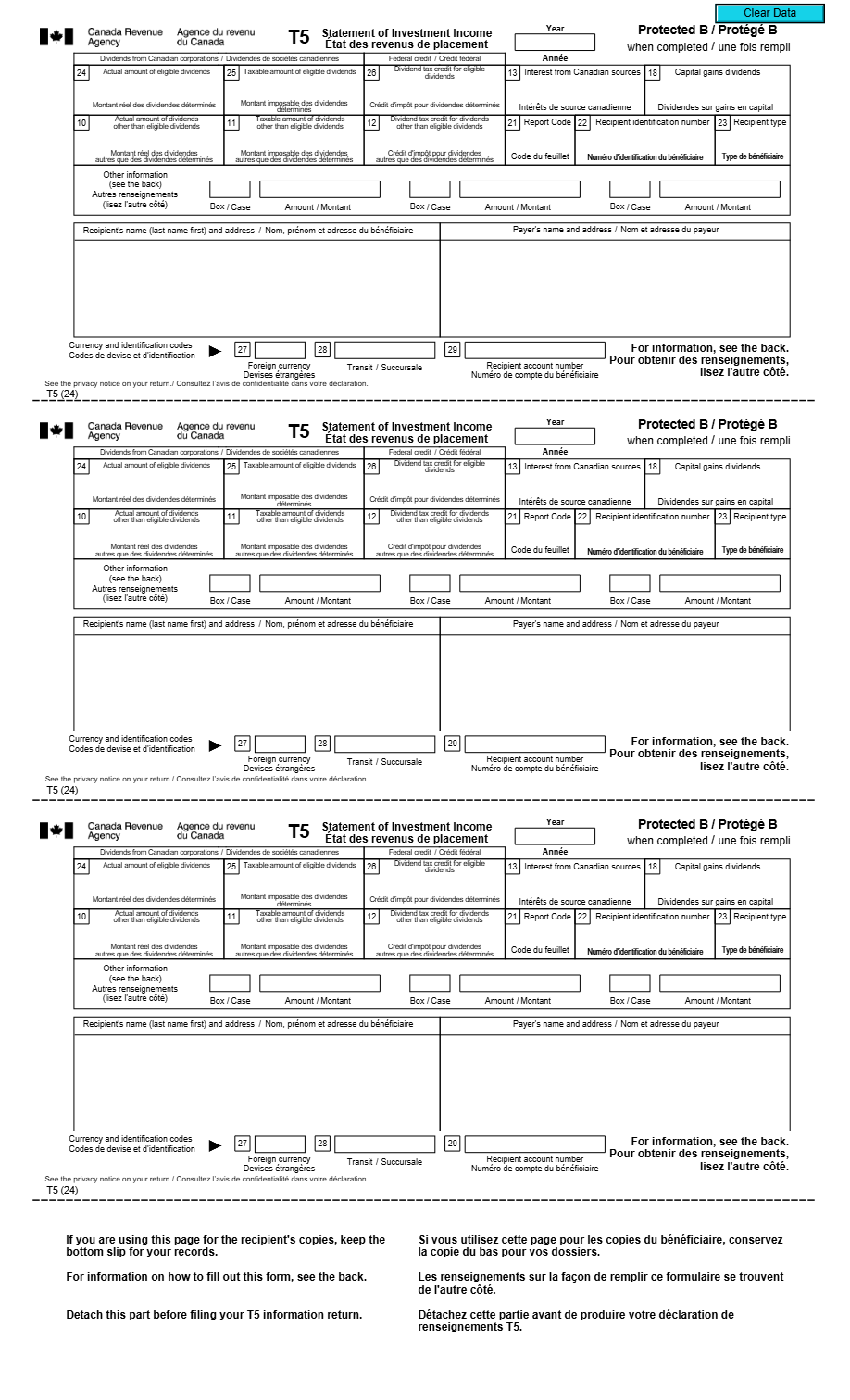

What is T5 Form?

The T5 form is a tax statement used in Canada to report investment income, such as dividends and interest earned during the fiscal year.

What is Form T5 used for?

It is used to report investment income to the Canada Revenue Agency (CRA), allowing for the accurate calculation of owed taxes or applicable tax credits.

Who should complete Form T5?

It must be completed by financial institutions, companies, and individuals who have paid or received more than $50 in investment income.

Legal and regulatory information

Filing the T5 form is mandatory under Canadian tax law to ensure transparency in income reporting and accurate tax collection.

How to fill out T5 Form?

Provide the complete name and address of the investment income payer.

Enter the recipient's full name and Social Insurance Number or tax identification number.

Select the type of income, such as dividends, interest, or other investment income.

Enter the total amount received during the fiscal year for each type of income.

Provide the account number related to the investment income if applicable.

Fill out your T5 Form here

Some important tips

FAQ about T5 Form

You should contact the issuing entity to correct the error and issue a new corrected form.