Fill Out T3012A

1. Open the form

Access the pre-loaded form directly in our PDF editor. No need to upload anything!

2. Fill in your details

Carefully complete all required fields to ensure accuracy and validity.

3. Download as PDF

Save your filled-out form in PDF format, ready for submission or other needs.

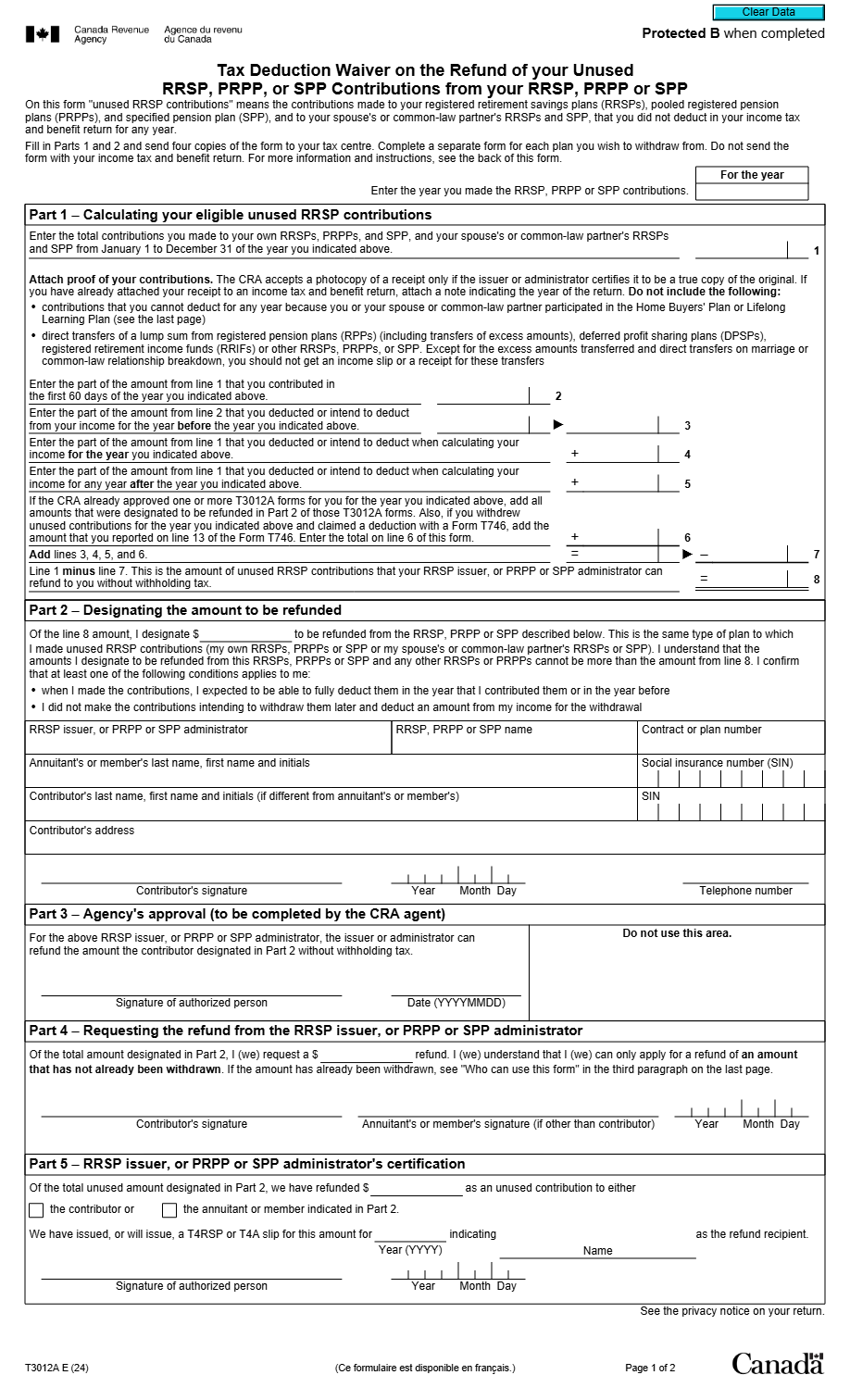

What is T3012A Form?

The T3012A Form is a Canadian tax tool used by individuals who need to withdraw funds previously contributed to a Registered Pension Plan (RPP). This form allows the withdrawal to be made without incurring immediate tax, ensuring a direct transfer within the regulatory tax framework.

What is Form T3012A used for?

The T3012A form is used to request authorization from the Canada Revenue Agency (CRA) to transfer amounts from an RPP to a Registered Retirement Savings Plan (RRSP or another RPP) without having to pay withholding tax at the time of withdrawal.

Who should complete Form T3012A?

This form must be completed by Canadian individuals who wish to transfer funds from one RPP to another RPP or RRSP without the immediate tax impact that usually accompanies a withdrawal from such plans.

Legal and regulatory information

Compliance with tax requirements when completing form T3012A is critical to avoid penalties from the CRA. It's important for applicants to ensure all information is accurate and that the transfer procedure is duly authorized, in accordance with the prevailing rules relating to RPPs.

How to fill out T3012A Form?

Enter your full name and social insurance number. Ensure these details match the information on your previous RPP.

Provide the RPP details, including the account number and the name of the plan administrator. This is required to process the fund transfer correctly.

Specify to which RRSP account you wish to transfer the funds. Include the account number and any special code provided by the RRSP administrator.

Sign and date the form to authorize the transfer of funds. Ensure that signatures are not incomplete or illegible.

Fill out your T3012A Form here

Some important tips

FAQ about T3012A Form

Without CRA authorization, your transfer may be considered a withdrawal and subject to withholding taxes.