Fill Out NR4

1. Open the form

Access the pre-loaded form directly in our PDF editor. No need to upload anything!

2. Fill in your details

Carefully complete all required fields to ensure accuracy and validity.

3. Download as PDF

Save your filled-out form in PDF format, ready for submission or other needs.

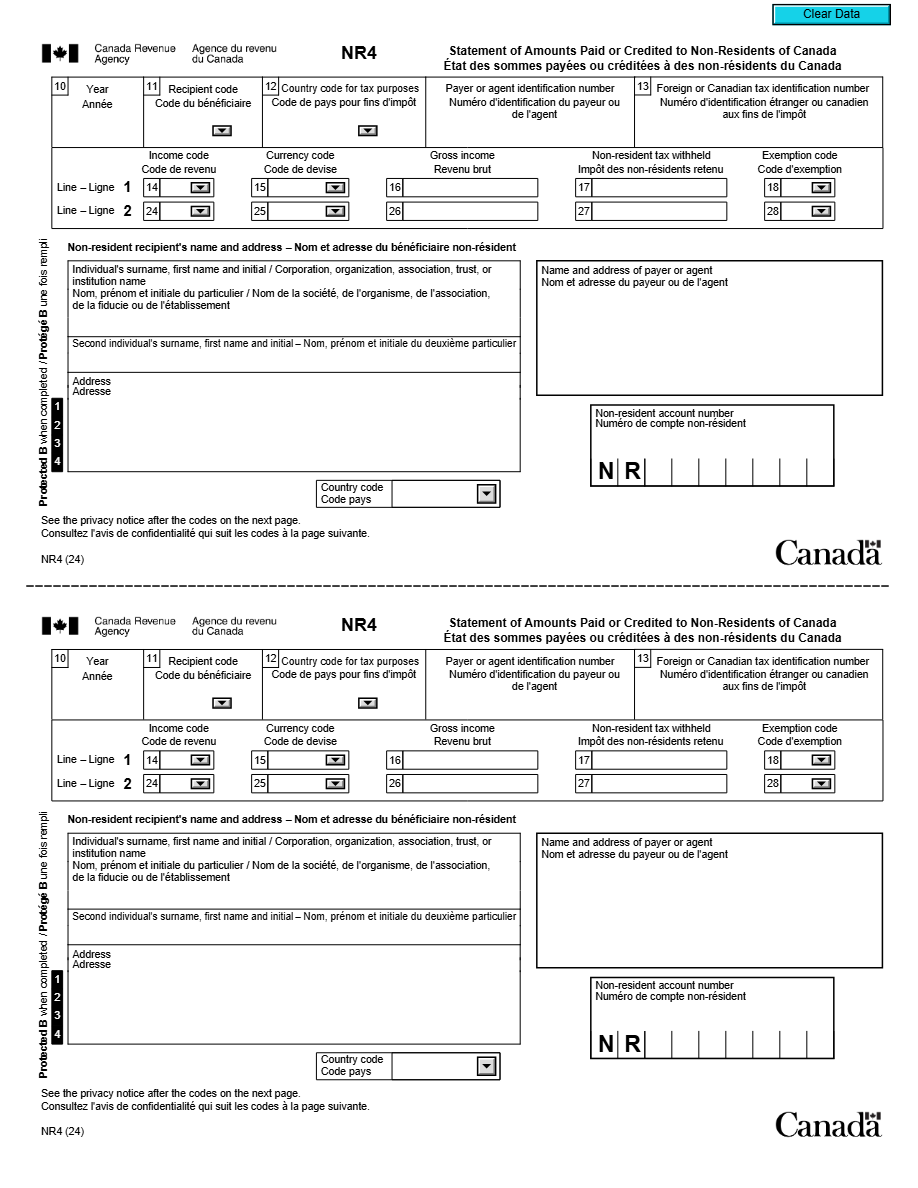

What is NR4 Form?

The NR4 Form is a document used in Canada to report amounts paid or credited to non-residents. This form is issued by payers to report income subject to withholding tax at source for the benefit of non-residents.

What is Form NR4 used for?

The form is used to report annual income, such as pensions or rents, that has been paid to non-residents of Canada. It also details any tax amount withheld at source during the fiscal year.

Who should complete Form NR4?

This form must be completed by any entity in Canada, such as businesses and investment funds, that has made payments to non-residents. It also applies to individuals who manage such payments on behalf of non-residents.

Legal and regulatory information

The NR4 Form is necessary to comply with Canadian tax regulations governing the taxation of amounts paid to non-residents. Failure to submit it may result in legal and financial penalties.

How to fill out NR4 Form?

Provide the full contact details of the payer, including name, address, and tax account number if applicable.

Include the full name and address of the recipient to whom payments or credits were made.

Specify the gross amounts paid to the non-resident recipient during the year, differentiating types of income such as pensions, rents, etc.

Indicate any amounts of tax withheld at source on payments to non-residents.

Briefly describe the type of income the non-resident recipient has received.

Record the specific date of each payment made to the recipient during the fiscal year.

Provide the recipient identification number that corresponds to the non-resident recipient if available.

Fill out your NR4 Form here

Some important tips

FAQ about NR4 Form

The NR4 Form must be filed by the last day of March of the year following the fiscal year of the payments.