Fill Out IRS W-9 Form

1. Open the form

Access the pre-loaded form directly in our PDF editor. No need to upload anything!

2. Fill in your details

Carefully complete all required fields to ensure accuracy and validity.

3. Download as PDF

Save your filled-out form in PDF format, ready for submission or other needs.

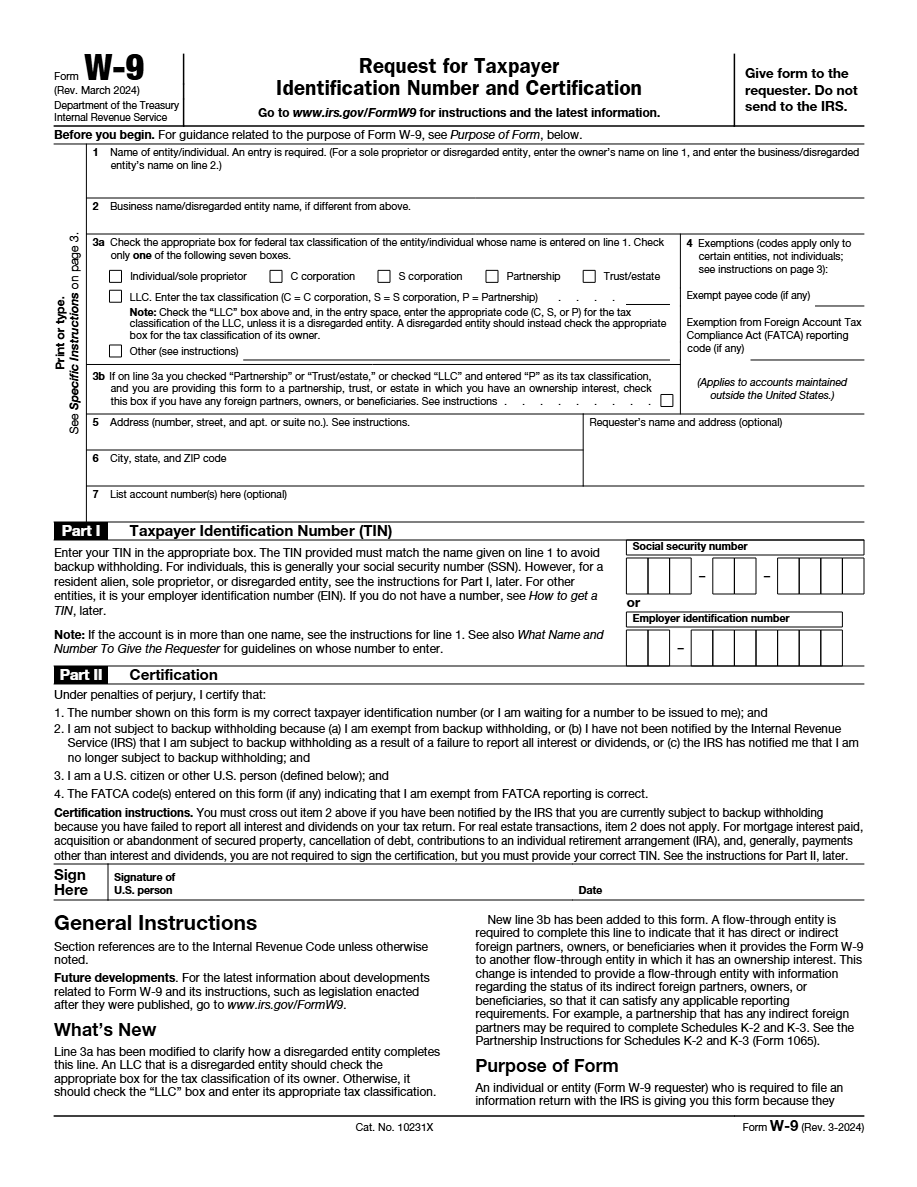

What is IRS W-9 Form Form?

The IRS Form W-9, also known as 'Request for Taxpayer Identification Number and Certification,' is a document used by the Internal Revenue Service (IRS) of the United States. This form is important for freelancers and independent contractors working with U.S. companies, as it allows the client company to obtain the taxpayer's identification number for reporting payments made to these workers.

What is Form IRS W-9 Form used for?

The W-9 Form is used to provide a taxpayer's identification number to an entity or person who needs it for reporting income paid. It is commonly used by employers to obtain the necessary information from freelancers and contractors.

Who should complete Form IRS W-9 Form?

Form W-9 must be completed by any U.S. person or entity who has received payments subject to tax reporting, such as independent contractors, freelancers, or other entities that are not direct employees.

Legal and regulatory information

This form is not sent to the IRS; it is directly provided to the paying person or entities. It is mainly used to ensure that payments to individuals and entities are properly reported for tax purposes. Failure to correctly complete a W-9 can result in penalties or additional tax withholding.

How to fill out IRS W-9 Form Form?

Enter your full name as it appears on your official tax documents. If you are operating under a different business name (DBA), include it as well.

Provide your Social Security Number (SSN) if you are an individual, or Employer Identification Number (EIN) if you are an entity.

Sign the form to certify that the information provided is accurate. This step is crucial for the form's validity.

Enter the address where you are fiscally associated. This is the address that will be used for any tax-related correspondence.

If applicable, check this box to indicate that you are exempt from backup withholding.

Fill out your IRS W-9 Form Form here

Some important tips

FAQ about IRS W-9 Form Form

The W-9 Form should be sent to the requester — that is, the entity or person needing the certification, not the IRS.