Fill Out IRS 1040-X Form

1. Open the form

Access the pre-loaded form directly in our PDF editor. No need to upload anything!

2. Fill in your details

Carefully complete all required fields to ensure accuracy and validity.

3. Download as PDF

Save your filled-out form in PDF format, ready for submission or other needs.

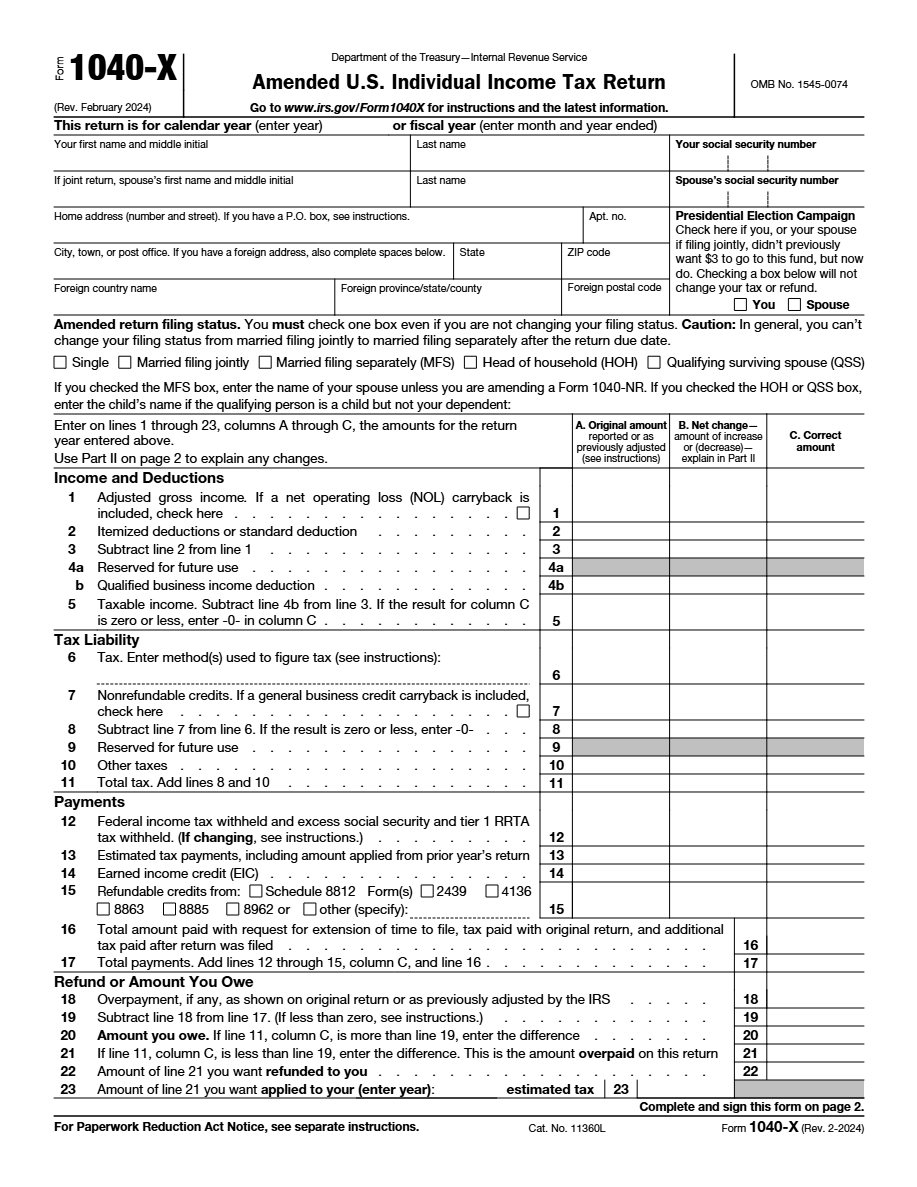

What is IRS 1040-X Form Form?

The IRS Form 1040-X is a form used to correct errors on a previously filed tax return with the Internal Revenue Service (IRS) in the United States. This form allows taxpayers to make amendments on their return to include additional information or correct errors in the calculation of income, deductions, credits, or the marital status declared.

What is Form IRS 1040-X Form used for?

Form 1040-X is primarily used to correct or amend tax returns filed with errors or to claim additional credits that were not included in the original return. It’s also useful if you forget to report some sources of income or omit valid deductions or credits.

Who should complete Form IRS 1040-X Form?

Anyone who has discovered errors on a previously filed tax return, needs to adjust income, deductions, or credits, or must change their marital status for tax purposes after the filing should complete Form 1040-X.

Legal and regulatory information

The use of Form 1040-X is regulated by the U.S. Internal Revenue Code. Filing this form must be done on paper, except for exceptions allowed by the IRS for electronic submission. It is important to file it within the statute of limitations, which is generally three years from the date the original return was filed or within two years after the tax was paid, whichever is later.

How to fill out IRS 1040-X Form Form?

Fill in all your personal information, ensuring your full name and Social Security Number exactly match IRS records.

Clearly explain the reason for the correction, indicating specific changes and reasons for the adjustment. Use the appendix if necessary.

Detail changes in income, deductions, and credits in the given columns, ensuring to recalculate the tax owed or refund.

Attach necessary schedules that provide additional details or support for the changes. This may include additional forms.

Ensure you sign and date the form, as amendments are not valid without a signature.

Fill out your IRS 1040-X Form Form here

Some important tips

FAQ about IRS 1040-X Form Form

The IRS has allowed electronic filings for Form 1040-X since 2019 for original returns filed electronically.