Fill Out GST370

1. Open the form

Access the pre-loaded form directly in our PDF editor. No need to upload anything!

2. Fill in your details

Carefully complete all required fields to ensure accuracy and validity.

3. Download as PDF

Save your filled-out form in PDF format, ready for submission or other needs.

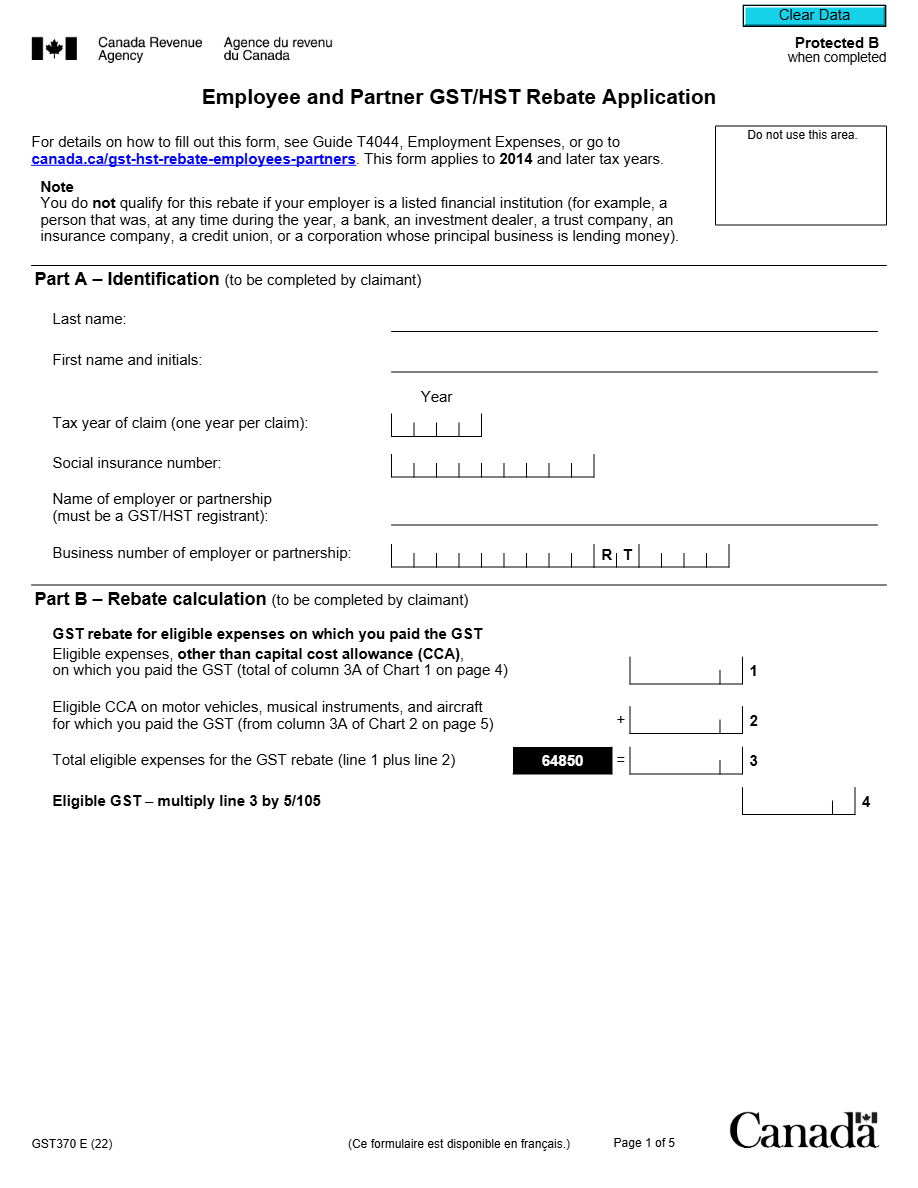

What is GST370 Form?

Form GST370 is a document used by consumers in Canada who have paid the Goods and Services Tax (GST) on certain purchases and wish to claim a refund. This form allows users to reclaim the GST paid in specific situations permitted by law.

What is Form GST370 used for?

It is primarily used to claim a refund of the GST paid on certain goods and services that qualify under current regulations.

Who should complete Form GST370?

It must be completed by consumers in Canada who have made specific purchases where GST refund is applicable.

Legal and regulatory information

The form must be submitted following guidelines set by the Canada Revenue Agency (CRA). It is important to comply with all legal regulations related to claiming GST refunds.

How to fill out GST370 Form?

Enter your full name and address as it appears on your tax documentation. Ensure all information matches your official records.

Provide complete details about the goods or services purchased, including the purchase date and the amount of GST paid.

Clearly explain why you are claiming a GST refund and attach any required supporting documentation.

Sign the form to certify the accuracy of the information provided. A digital signature is acceptable if filed electronically.

Fill out your GST370 Form here

Some important tips

FAQ about GST370 Form

Processing times vary, but it generally takes 4 to 6 weeks.