Fill Out Form TD1

1. Open the form

Access the pre-loaded form directly in our PDF editor. No need to upload anything!

2. Fill in your details

Carefully complete all required fields to ensure accuracy and validity.

3. Download as PDF

Save your filled-out form in PDF format, ready for submission or other needs.

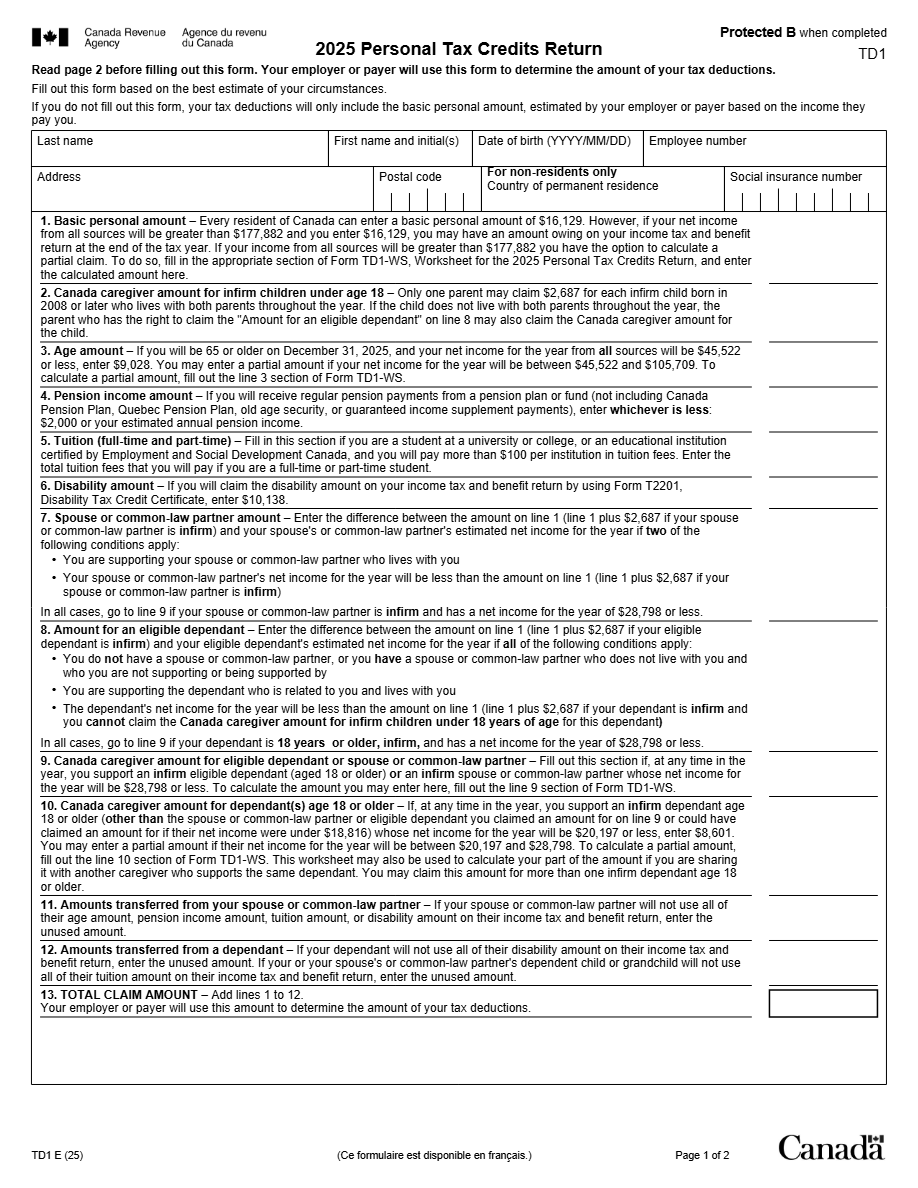

What is Form TD1 Form?

Form TD1 is Canada's Personal Tax Credits Return form, primarily used to calculate the amount of tax to be deducted from an individual's income throughout the fiscal year.

What is Form Form TD1 used for?

This form is used to determine the amount of personal tax credits an individual is eligible for, thereby affecting the amount of their income to be withheld for taxes. It is also used when there are changes in personal circumstances that may affect deductions, such as marital status or number of dependents.

Who should complete Form Form TD1?

Every employee in Canada must complete the TD1 form at the start of employment or when their personal circumstances significantly change during the year.

Legal and regulatory information

The TD1 form is not a tax return, but it is a mandatory document under Canadian tax laws used to calculate tax withholdings during the year. Completing it correctly ensures that the correct amount of tax is withheld from the individual's income, avoiding overpayments or tax debts at the end of the year.

How to fill out Form TD1 Form?

Provide your full name, address, and social insurance number. It is important for this information to be accurate to ensure proper tax withholding.

Indicate your current marital status as it affects applicable tax credits.

Calculate your personal credits based on the provided information such as dependents and other personal circumstances.

Ensure to sign and date the form before submitting. This is necessary to validate it.

Fill out your Form TD1 Form here

Some important tips

FAQ about Form TD1 Form

If you do not complete the TD1 form, your employer will withhold taxes at the basic rate without considering your eligible personal credits, which could result in higher tax withholdings.