Fill Out Form T3

1. Open the form

Access the pre-loaded form directly in our PDF editor. No need to upload anything!

2. Fill in your details

Carefully complete all required fields to ensure accuracy and validity.

3. Download as PDF

Save your filled-out form in PDF format, ready for submission or other needs.

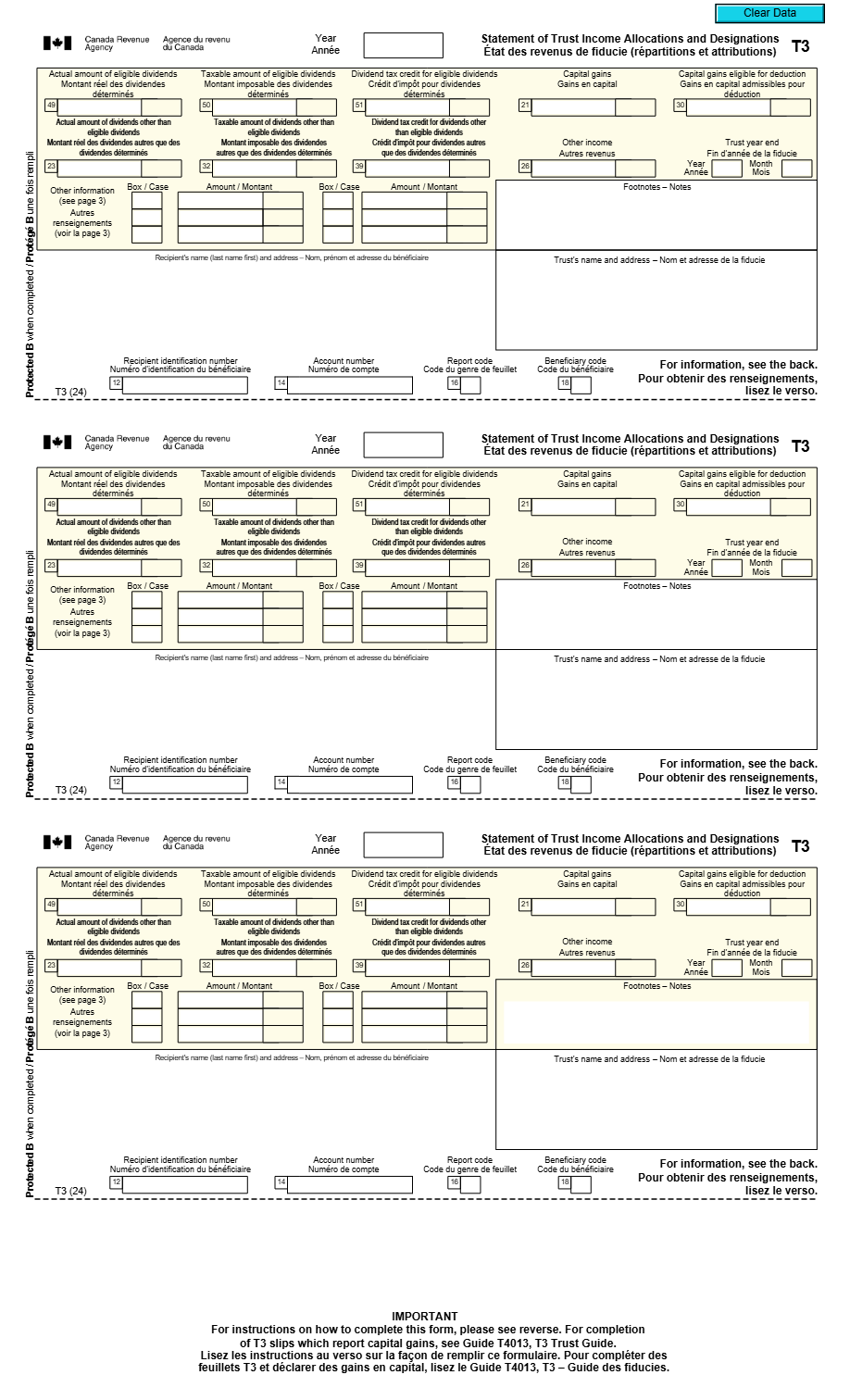

What is Form T3 Form?

The T3 form is a tax document used in Canada to report income from a trust.

What is Form Form T3 used for?

This form is used to report income, deductions, and credits of a trust for tax purposes.

Who should complete Form Form T3?

It must be completed by trustees or administrators of trusts in Canada that have income to report.

Legal and regulatory information

The T3 form is regulated by the Canada Revenue Agency (CRA) and must be filed annually.

How to fill out Form T3 Form?

1

Trust Information

Provide the full name and address of the trust as it is legally registered.

Provide the full name and address of the trust as it is legally registered.

2

Trust Account Number

Enter the account number assigned to the trust by the CRA.

Enter the account number assigned to the trust by the CRA.

3

Total Income

Report all income the trust received during the fiscal year, including dividend income, interest, and other sources.

Report all income the trust received during the fiscal year, including dividend income, interest, and other sources.

4

Applicable Deductions

List all deductions the trust can claim, such as administrative expenses and fees.

List all deductions the trust can claim, such as administrative expenses and fees.

5

Tax Credits

Write down any applicable tax credits that can be applied to the trust.

Write down any applicable tax credits that can be applied to the trust.

6

Signature and Certification

The trustee must sign and certify that all information provided is truthful and correct.

The trustee must sign and certify that all information provided is truthful and correct.

Fill out your Form T3 Form here

Some important tips

!

Use the same name as appears on the trust's legal documents.

!

Ensure you gather all income slips before completing the form.

!

Double-check figures to avoid common mistakes that could lead to penalties.

!

If in doubt, consult with a tax advisor specialized in trusts.

FAQ about Form T3 Form

The T3 form must be filed by March 31st of the year following the trust's fiscal year.