Fill Out Form 8854

1. Open the form

Access the pre-loaded form directly in our PDF editor. No need to upload anything!

2. Fill in your details

Carefully complete all required fields to ensure accuracy and validity.

3. Download as PDF

Save your filled-out form in PDF format, ready for submission or other needs.

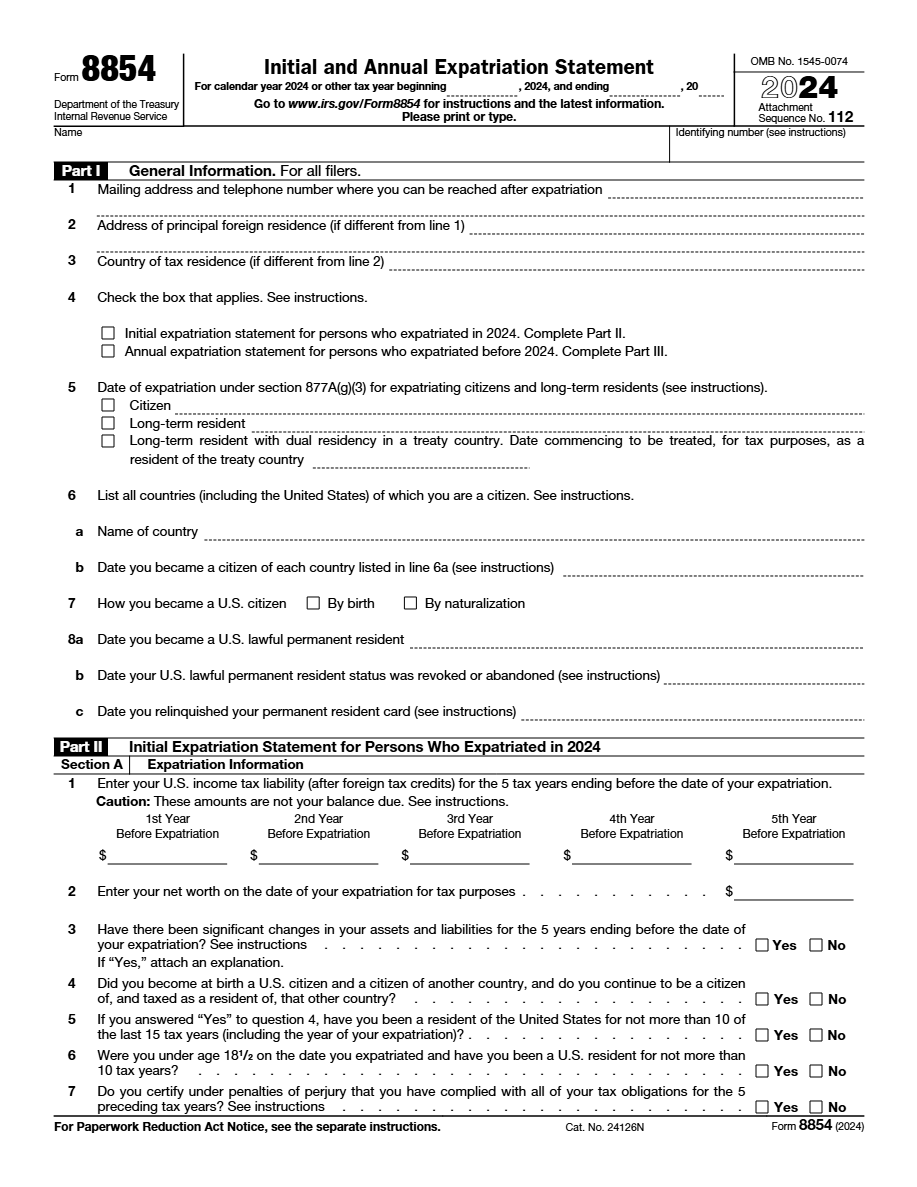

What is Form 8854 Form?

Form 8854, known as the "Initial and Annual Expatriation Statement," is a document from the United States Internal Revenue Service (IRS). It is designed to comply with tax regulations concerning individuals who renounce their U.S. citizenship or terminate their permanent residency in the country.

What is Form Form 8854 used for?

The form is used to establish an individual's financial status at the time of expatriation. This is crucial for fulfilling tax obligations and determining whether one is subject to the exit tax.

Who should complete Form Form 8854?

This form must be completed by individuals who plan to renounce their U.S. citizenship or terminate their permanent residency in the United States. This ensures compliance with the tax requirements set by the IRS.

Legal and regulatory information

Form 8854 must be completed in accordance with sections 877, 2107, and 2501 of the Internal Revenue Code. Failure to provide this form may result in penalties and the imposition of the exit tax.

How to fill out Form 8854 Form?

Enter your full name, taxpayer identification number, and current address. If you have changed your name since your last tax return, be sure to include supporting documentation.

Provide the date you renounced your citizenship or terminated your permanent residency. This date is crucial for correctly calculating any taxes owed.

List the values of all financial assets in your possession at the time of expatriation. This includes properties, investments, and savings accounts both in the United States and abroad.

Include all outstanding debts or significant financial liabilities. This will help determine your net tax situation accurately.

Calculate the exit tax based on the difference between your assets and liabilities. Be sure to follow the specific instructions provided by the IRS under Section 877A of the Internal Revenue Code.

Fill out your Form 8854 Form here

Some important tips

FAQ about Form 8854 Form

You must file the form no later than the due date of your U.S. tax return for the year after your expatriation.