Fill Out 14039

1. Open the form

Access the pre-loaded form directly in our PDF editor. No need to upload anything!

2. Fill in your details

Carefully complete all required fields to ensure accuracy and validity.

3. Download as PDF

Save your filled-out form in PDF format, ready for submission or other needs.

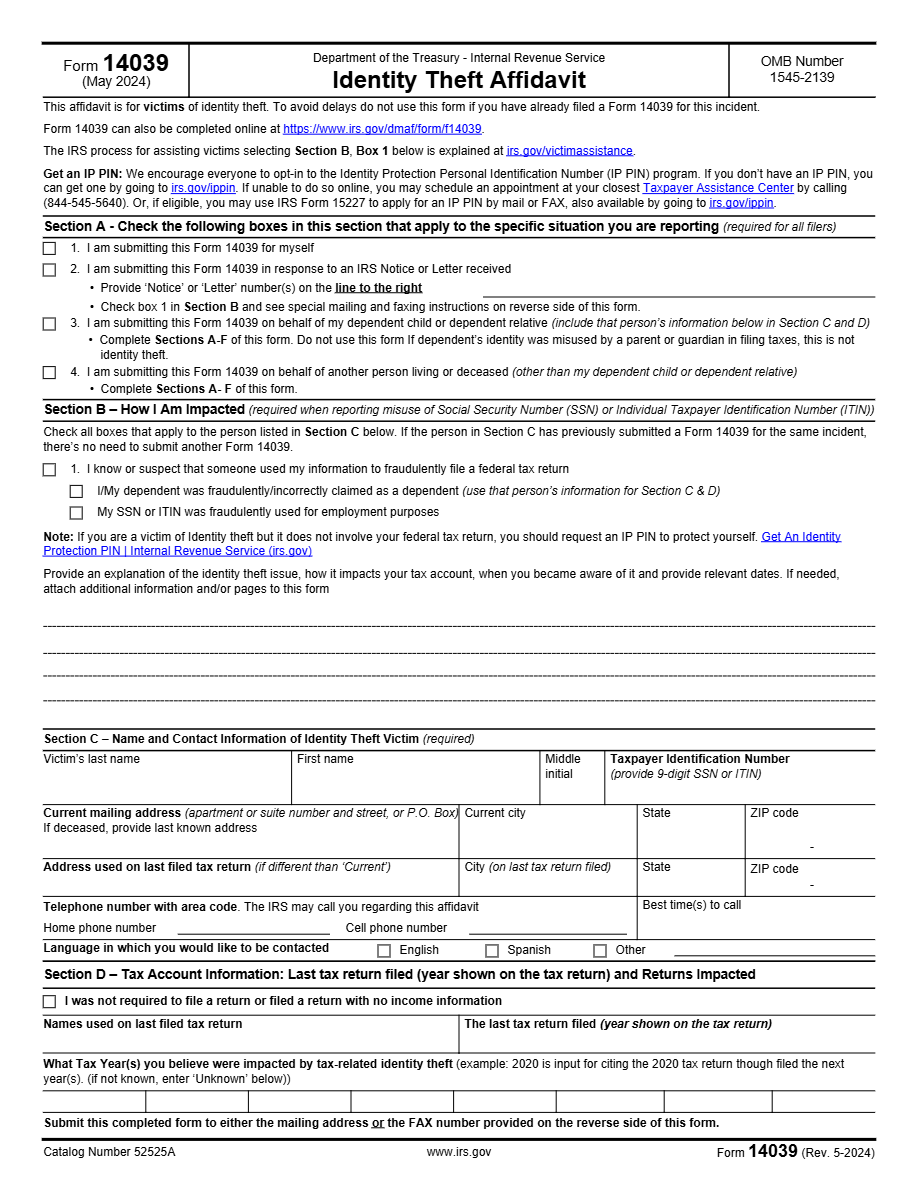

What is 14039 Form?

Form 14039, or Identity Theft Affidavit, is an official document from the United States Internal Revenue Service (IRS). This form allows individuals to notify the IRS about potential identity theft that may be affecting their tax situation.

What is Form 14039 used for?

Form 14039 is used to alert the IRS about situations where personal information has been compromised and used to file fraudulent tax returns.

Who should complete Form 14039?

This form should be completed by individuals who suspect they are victims of identity theft and that this act has affected their tax information with the IRS.

Legal and regulatory information

Filing Form 14039 is a legal declaration that informs the IRS about potential misuse of an individual's tax information due to identity theft. It is regulated by IRS policies to protect the tax integrity of affected individuals.

How to fill out 14039 Form?

Provide your full name, Social Security Number or ITIN, and current address where you wish to be contacted.

Briefly explain the identity theft situation, including any affected tax returns and known fraudulent actions.

Sign and date the form to certify that all the provided information is true and correct to the best of your knowledge.

Fill out your 14039 Form here

Some important tips

FAQ about 14039 Form

If you have received a notification from the IRS about a potential discrepancy in your tax return or suspect fraudulent activities using your identity.